As a single parent, planning for your child’s college education may feel overwhelming, especially when juggling other responsibilities like the demands of our everyday lives. With the right strategies in place and an early start, you can set your child up for success. College is undeniably a significant investment. Let’s ease the burden by preparing today.

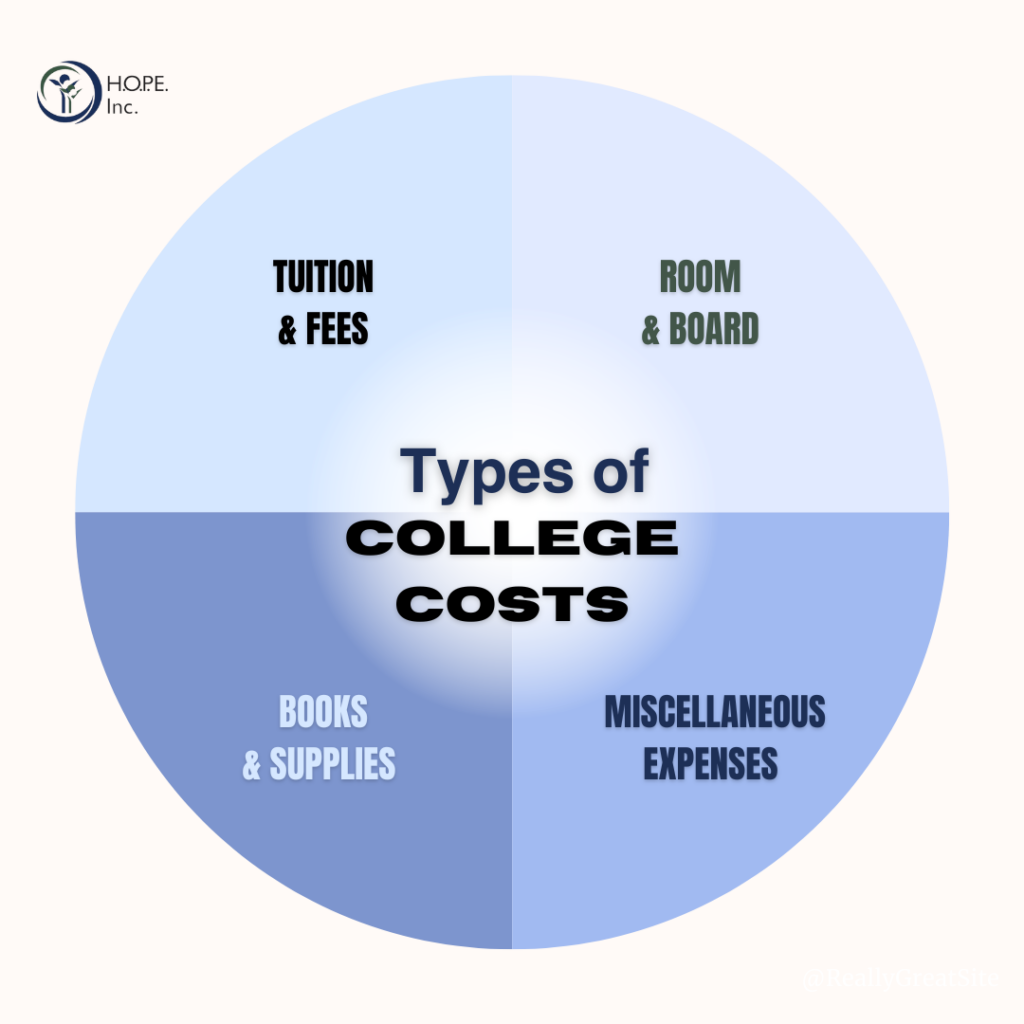

Understanding the Costs

Tuition is just one part of the equation—books, room and board, supplies, transportation, and personal expenses all add up. Knowing what to expect can help you plan more effectively. According to recent studies, the average cost of tuition and fees for the 2023-2024 academic year is around $10,560 for in-state public colleges and can exceed $38,000 at private institutions. With costs continuing to rise, saving for college early can make a huge difference in covering these expenses without relying solely on loans or financial aid.

Steps to Start Saving for College

For single parents, saving for college can often feel like an uphill battle. By being proactive and saving in advance, you’ll relieve some of the financial pressure from you and your child and enable them to focus on their studies. Even small amounts saved consistently can add up over time.

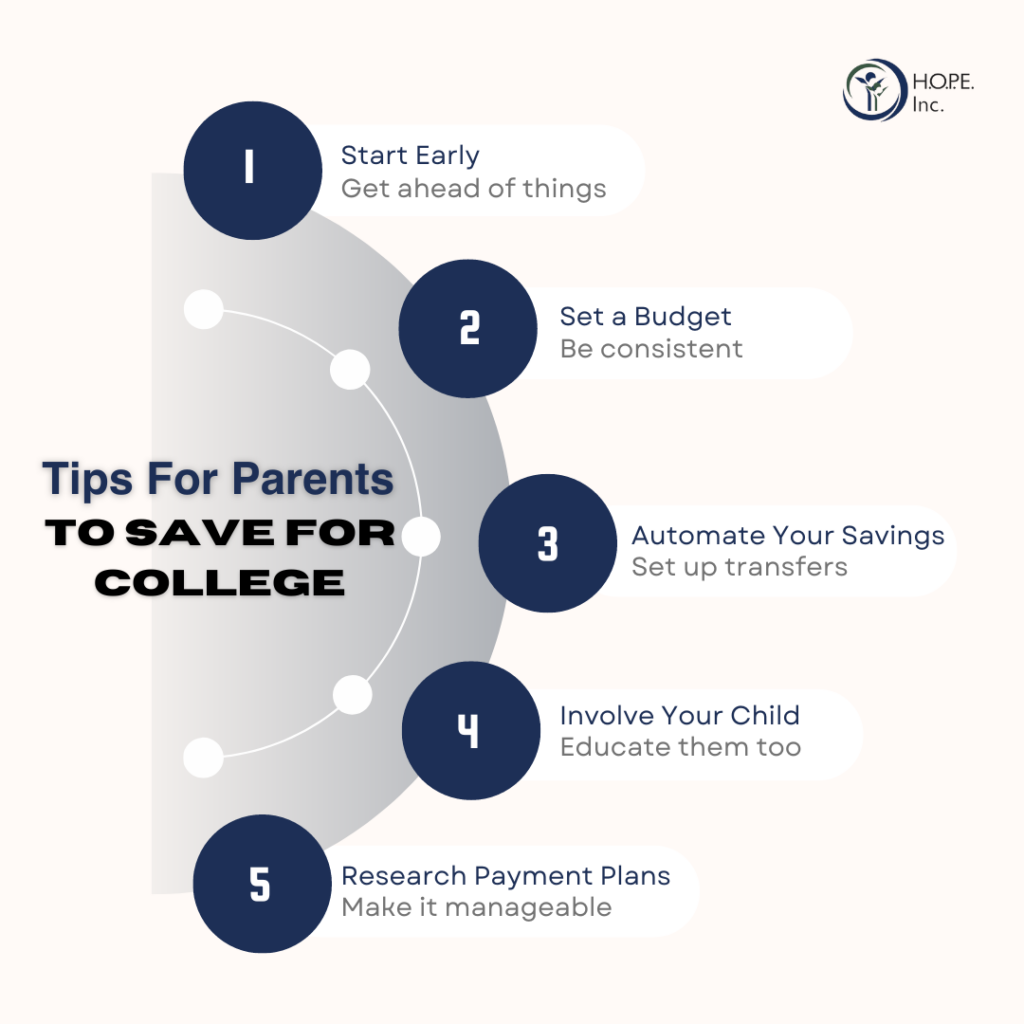

Here are a few key strategies to help you start saving:

- Start Early: 529 savings plans are specifically designed for education expenses and offer tax advantages. The earlier you start, the more time your investment has to grow.

- Set a Budget: You need to be realistic. No, you don’t have to save the full cost of college, but a good starting point is aiming to cover one-third of the total cost, leaving room for grants, scholarships, and loans to fill the gaps.

- Automate Your Savings: Set up automatic transfers into a designated college savings account. This makes saving easier and ensures you contribute regularly.

- Involve Your Child: As your child gets older, involve them in the savings process. Encourage them to contribute towards their future through part-time jobs or set up a savings goal for them to reach before graduation.

- Research Payment Plans: College can be affordable if you do your homework and identify payment plan options, as well as financial aid opportunities to help take the weight off of you.

Educate your child about their financial aid options. Help them complete their Free Application for Federal Student Aid (FAFSA) form during their senior year of high school to determine eligibility for federal grants, work-study programs, and low-interest federal loans. This will help your child achieve their educational goals without compromising your own financial future.

Remember that taking small, consistent steps toward saving can make a significant impact. At H.O.P.E., Inc., we’re committed to helping single parents navigate the challenges of paying for college and we understand the challenges of balancing finances while planning for the future. We’re here to help you break down the steps needed to save for your child’s education. If you need support or guidance, reach out.